Splint Invest Review – A 3-Month Journey into Luxury Investments

Investing in the luxury market has always been an intriguing endeavor, and my experience with Splint Invest, a Swiss startup specializing in fractional ownership of luxury items, has been nothing short of impressive.

Over the past three months, I’ve closely monitored the performance of my Splint portfolio, which includes shares in various luxury assets such as artworks, luxury cars, high-end watches, fine wines, champagne, whiskey, and even collectible Lego sets. What stands out prominently is the remarkable stability exhibited by these investments.

Our bonus gift, if you want to try out this luxury goods investment platform: Begin your investment journey with €50 free of charge !

Portfolio diversification

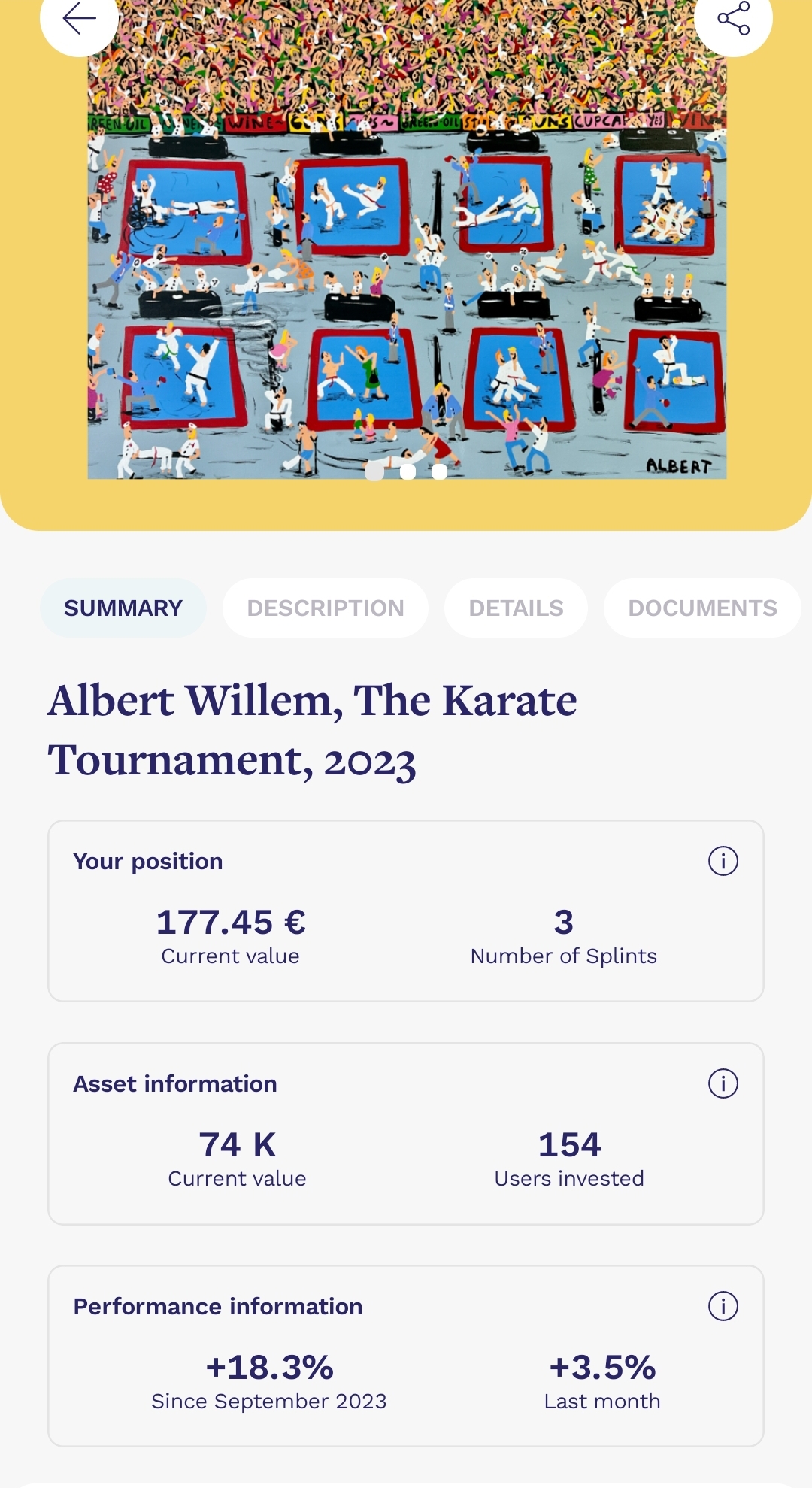

A mere 2% of my Splint holdings experienced a slight decrease in value, while the remaining assets showed consistent growth. Notably, a piece of artwork in my portfolio surged by an astounding 18.3% in just three months. This not only demonstrates the resilience of the luxury market but also underscores the potential for significant returns.

This piece of artwork in my portfolio surged by an astounding 18.3% in just three months.

The diversification across different luxury categories appears to be a strategic move by Splint Invest, as it mitigates risks and contributes to the overall stability of the investment platform. This is particularly reassuring for investors like me who seek a balance between risk and reward.

Overall increase of my portfolio

One of the standout aspects of my Splint Invest journey is the overall increase in my investment by a proud 5%. This substantial growth over a relatively short period reflects not only the soundness of my investment decisions but also the effectiveness of Splint’s platform in curating a robust portfolio.

Splint Invest has not only provided a gateway into the exclusive world of luxury investments but has also exceeded my expectations in terms of performance and stability. The user-friendly interface, coupled with transparent insights into each asset’s performance, has made the investment journey both enjoyable and rewarding.

As I continue to navigate the dynamic landscape of luxury investments with Splint, I look forward to uncovering further opportunities and witnessing the continued growth of my portfolio. For anyone considering venturing into the realm of luxury investments, Splint Invest stands out as a promising and reliable platform worth exploring.

Enticing investment opportunities

The allure of Splint Invest lies in its diverse and enticing array of investment opportunities.

From the captivating strokes of a Marc Chagall masterpiece to the timeless elegance of a Pablo Picasso drawing, the platform opens doors to the art world’s finest. Moving beyond visual art, investors can also partake in the luxury lifestyle, with sought-after items such as a magnum of Petrus, Dom Perignon Champagne, and iconic luxury cars including Ferrari, Porsche, Aston Martin, and Lamborghini.

For horology enthusiasts, Splint Invest offers the chance to invest in the craftsmanship of renowned watchmakers like Audemars Piguet and Patek Philippe.

The world of fashion is not left behind, with opportunities ranging from an iconic Hermes handbag to the everlasting appeal of diamonds (1.71 carats), a stunning sapphire, and even a kilogram platinum ingot.

Each investment holds its unique charm, contributing to the platform’s appeal as a comprehensive and captivating avenue for luxury asset enthusiasts.

The timeless elegance of a Pablo Picasso drawing. The Painter II – autoportrait

Splint Invest: Start now with 50 euros free of chargeRegister now with Splint Invest and diversify your portfolio with alternative investments, like an expert: |

*Disclaimer: Investment in luxury assets involves inherent risks, and individual results may vary. Always conduct thorough research and consider consulting with a financial advisor before making investment decisions.*